best buy 401k withdrawal

Did you just have to. Contributions to a 401 k are handled by your employer via payroll deductions.

Should I Close My 401k Withdraw Retirement Savings

Skip to page content.

. If you are under that age the penalty is 10 of the total. Traditional or Rollover Your 401k Today. If you wait until after you are 59 12 you can withdraw without any penalties even if you arent retired.

If your companys 401 k allows periodic withdrawals ask about transaction fees particularly if you plan to withdraw money frequently. 627 employees reported this benefit. If you dont youre subject to a 50 tax penalty on.

You can withdraw from a 401 k distribution without penalty if you are at least 59½. You can roll over the funds from your Best Buy 401 k into the new employers plan and effectively pay no. Best buy 401k withdrawal 401k Withdrawal Rules For Home Purchases 2021 When Is It Ok To Withdraw Money Early From Your 401k.

Permanent or total disability. Penalty-Free 401K Withdrawal Rules. You can start withdrawing funds from a 401 k or IRA without penalty after age 59 12 but you dont have to start taking required minimum distributions RMDs from tax-deferred.

It does not however mean tax-free. Best Buy matches 401k contributions up to your 5 contribution to a 401k plan Report 1 2 3 4 5 Viewing 1 - 10 of 310 Reviews Affiliated Companies Best Buy Parent Company 35 Best Buy. I know BBY setup some special provisions for financial hardship and such.

About one-third of all 401 k plans. Ad If you have a 500000 portfolio download your free copy of this guide now. Open an IRA Explore Roth vs.

Ad Make a Thoughtful Decision For Your Retirement. Todays Change -639 -4218 Current Price 61767 BLK Key Data Points Market Cap 94B Days Range 61767 - 64860 52wk Range 58258 -. Ad If you have a 500000 portfolio download your free copy of this guide now.

There are exceptions for financial. Under the SECURE Act employees can withdraw up to 5000 from a retirement plan to cover the birth or adoption of a child penalty-free. If you had stock option for best buy then you have a fidelity account if you did then you can create a rollover account in fidelity and rollover your 401K and manage it your way or have fidelity do.

Usually when you get to your new employer they might have a 401 k option as well. Just seeing if anyone has pulled from their 401K during the pandemic. Thus your 401 k plan administrator will withhold a mandatory 20 from the amount requestedalthough you may end up owing more depending on your income level.

Skip to page content. Although this withdrawal is taxable the standard 10. Understand Your Options - See When And How To Rollover Your 401k.

Ad It Is Easy To Get Started. You dont have to be retired to start withdrawing money from your 401 k. Pin On Buying Selling A Home How 401 K.

Under the old rules you could withdraw up to 50 of your vested balance or 50000 whichever is. Best Buy Retirement Plan. Schwab Has 247 Professional Guidance.

Coronavirus-Related Distribution CRD The aggregated maximum withdrawal amount across qualified plans and IRAs is 100000. Enter username and password to access your secure Voya Financial account for retirement insurance and investments. Alexandria Real Estate Equities ARE -278 is an office REIT that specializes in the life sciences sector.

In 2022 individuals can contribute up to 20500 to their account or 27000 if theyre aged 50 or. RMD rules mandate you withdraw a certain portion of your investment account balance each year after you reach age 72. 401 k loans existed before the pandemic though not all plans allow them.

The life sciences sector has different. Available to US-based employees Change location. Alexandria Real Estate Equities.

A penalty-free withdrawal allows you to withdraw money before age 59-12 without paying a 10 penalty.

My Most Recent Read Was On The Topic Of Meditation And Mindfulness On My Pursuit For Financial Independence I Want To Make Sure I Mindfulness Words Positivity

How Much To Save For Retirement Are You On Track Infographic Finance Infographic Money Management Budgeting

How Gold Can Benefit Your Ira Investment Tips Ira Investment Investing Money

401 K Early Withdrawal Guide Forbes Advisor

401 K Early Withdrawal Overview Penalties And Fees

6 Withdrawal Rules For Roth 401 K S The Motley Fool

When Is It Ok To Withdraw Money Early From Your 401k

401k Early Withdrawal What You Must Know Finance Saving Preparing For Retirement Money Saving Tips

How 401 K Tax On Withdrawals Can Hurt Your Finances Credit Karma Tax

Borrow From Your 401k Without Penalty Nextadvisor With Time

How To Withdraw From 401k Or Ira For The Down Payment On A House Pay Off Mortgage Early Reverse Mortgage Mortgage Loans

How To Withdraw Early From A 401 K Nextadvisor With Time

If Your Employer Lets You Decide Between A Traditional And A Roth 401 K Consider Choosing Both Traditional Roth Good Things

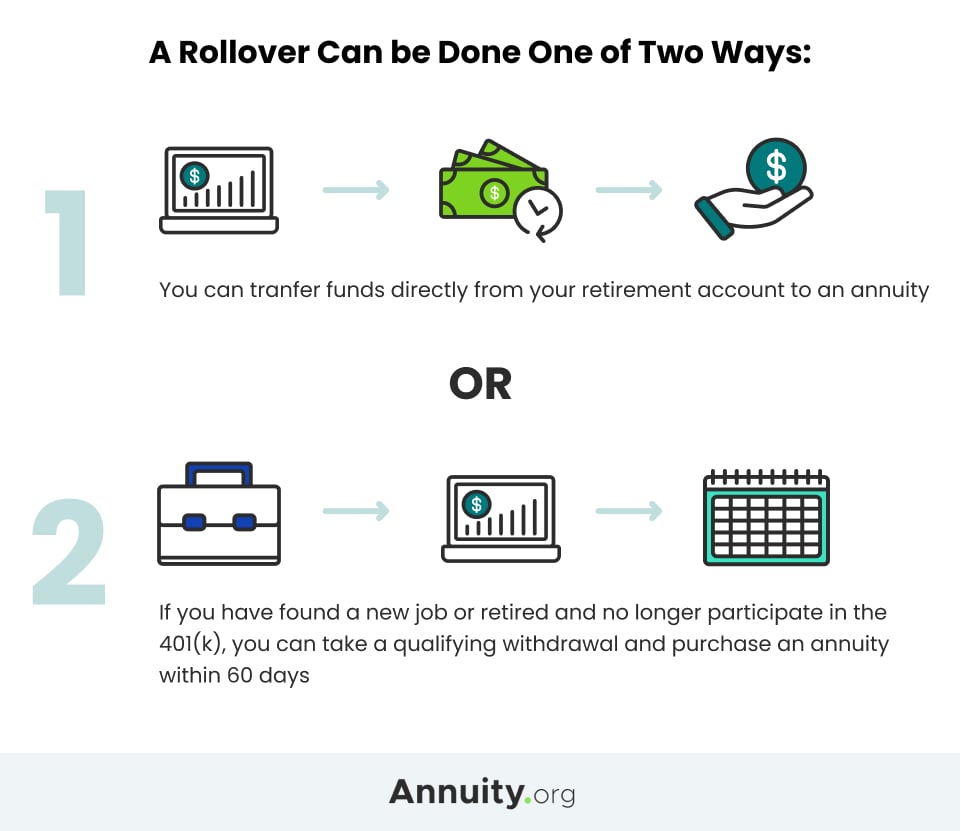

Annuity Rollover Rules Roll Over Ira Or 401 K Into An Annuity

How To Choose Between A Traditional And Roth 401 K Financial Decisions Divorce Piggy Bank

Cares Act 401k Withdrawal Edward Jones

401 K Withdrawals Everything You Need To Know Gobankingrates

Non Spouse Beneficiaries Rules For An Inherited 401k Inherited Ira Investing For Retirement Traditional Ira